“我们的香槟供不应求”:这是自金融危机以来英国银行家奖金最多的一次

正文翻译

‘We’ve had a run on champagne:’ Biggest UK banker bonuses since financial crash

-Bumper payouts are ‘kick in the teeth for everyone else suffering with the cost of living crisis’, say critics

“我们的香槟供不应求”:这是自金融危机以来英国银行家奖金最多的一次

——批评人士说,丰厚的奖金是“对其他所有遭受生活成本危机的人的打击”

(City workers drinking in Leadenhall Market, London.)

(在伦敦勒顿豪集市喝酒的城市工人。)

新闻:

This week British bankers will start collecting the biggest bonuses since before the 2008 global financial crisis as their employers fight an “increasingly intense war for talent”.

本周,英国银行家将开始领取自2008年全球金融危机前以来最高的奖金,因为他们的雇主正在进行一场“日益激烈的人才争夺战”。

As most Britons face the biggest squeeze on their incomes since at least 1990, already very highly paid bankers are celebrating “particularly obscene” bonuses in the City’s pubs and wine bars.

当大多数英国人面临着至少自1990年以来收入最大的压榨时,已经收入颇高的银行家们却在金融城的酒吧和酒吧里庆祝“高得特别令人发指的”奖金。

“We have had quite the run on champagne – the poshest champagne we stock,” says James, a bartender at the New Moon on the streets of Leadenhall Market near the headquarters of many of the City of London’s banks. “They come here to celebrate when they get told their ‘number’ – the numbers seem to have been particularly obscene this year.”

“我们已经卖掉了许多香槟——我们储备的最豪华的香槟,”詹姆斯说,他是伦敦金融城许多银行总部附近敦勒顿豪集市街道上的“新月”酒吧的酒保。“当他们被告知自己的‘(奖金)数字’时,他们来到这里庆祝——今年的数字似乎特别惊人。”

London’s mergers and acquisitions (M&A) bankers earned total fees of $3.5bn (£2.6bn) in 2021, according to research by financial data provider Refinitiv for the Guardian. It is the highest annual total for M&A banker fees paid since Refinitiv’s records began in 2000, fuelled by a frenzy of corporate takeovers sparked by a flood of private equity cash and acquisitive American buyers preying on undervalued British targets.

金融数据提供商Refinitiv为《卫报》开展的研究显示,伦敦并购银行家在2021年总共赚取了35亿美元(26亿英镑)的佣金。这是自2000年Refinitiv有记录以来,并购银行家支付的最高年度费用总额。私人股本资金的涌入,以及收购价值被低估的英国目标公司的美国买家,引发了一波企业收购热潮,推动了这一热潮。

That money is now set to be returned to bankers in their bonuses. London’s big four banks – HSBC, Barclays, Lloyds Banking Group and NatWest – are expected to pay out bonuses totalling more than £4bn when they report their annual results in the next fortnight. Combined, the banks’ annual profits are expected to exceed £34bn – the most since 2007 in the boom before the financial crisis.

这笔钱现在将作为奖金返还给银行家。伦敦的四大银行——汇丰银行、巴克莱银行、劳埃德银行集团和国民西敏西方银行——预计将在未来两周公布年度业绩时,发放总计逾40亿英镑的奖金。两家银行的年度利润合计预计将超过340亿英镑,为2007年金融危机前繁荣期以来的最高水平。

The bankers’ huge paydays come days after the governor of the Bank of England, Andrew Bailey, who was paid £575,538 last year, called on workers across the country not to ask their bosses for pay rises to help control inflation, which has soared to a 30-year high of 5.4%.

就在银行家们高薪日的几天前,英国央行行长安德鲁·贝利呼吁全国各地的工人们为了控制通货膨胀(已飙升至30年来的最高点——5.4%)不要向老板要求加薪。去年,贝利的年薪为575538英镑。

Gary Smith, general secretary of the GMB unx, which represents 600,000 mostly frontline workers, said: “These sky-high banker bonuses are a kick in the teeth for everyone suffering with the cost of living crisis. I hope Andrew Bailey tells his banking mates to show the same ‘restraint’ he so readily demands from underpaid workers in the rest of the economy.

主要代表60万名一线工人的英国总工会秘书长加里·史密斯表示:“对于每个因生活成本危机而煎熬的人来说,银行家的这些天价奖金是一个沉重打击。我希望安德鲁·贝利能告诉他的银行业伙伴,要表现出与其他经济领域薪资过低的员工同样的 ‘克制’”。

“Essential workers, like our nation’s carers, often earn pennies above the minimum wage,” Smith said. “Mr Bailey should step out of his banking bubble and shadow these workers to see the people who actually deserve a proper pay rise.”

史密斯说:“像我们国家的护理人员这样的基本工人,他们的收入往往只比最低工资高出几分钱。贝利先生应该走出他的银行泡泡,去看看这些工人,看看那些真正应该得到适当加薪的人。”

The bumper bonuses will tip several hundred more UK bankers into the EU’s “high earners” warning report which details every banker earning more than €1m (£835,000) a year. The European Banking Authority (EBA) found that 3,519 bankers working in the UK earned more than €1m-a-year last year – more than seven times as many as those working in Germany which has the second highest number of €1m-a-year bankers.

欧盟的“高收入者”警告报告详细列出了每一位年收入超过100万欧元(83.5万英镑)的银行家。欧洲银行管理局发现,去年有3519名在英国工作的银行家年收入超过100万欧元,是德国银行家年收入超过100万欧元人数(排在第二位)的7倍多。

The EBA figures show 27 UK bankers earned more than €10m in 2019 (the latest year available). Two UK-based asset managers were paid between €38m and €39m, and one merchant banker was paid €64.8m. That banker received fixed pay of €242,000, topped up with a bonus of €64.6m.

欧洲银行管理局的数据显示,2019年(现有数据的最近一年),有27名英国银行家的收入超过1000万欧元。两名驻英国的资产经理的薪酬在3800万欧元至3900万欧元之间,一名商业银行家的薪酬为6480万欧元。这名银行家的固定薪酬为24.2万欧元,外加6460万欧元的奖金。

Frances O’Grady, the general secretary of trade unx body the TUC, said the huge increase in bankers’ pay was “an insult to working families across Britain”.

英国劳工联合会秘书长弗朗西斯·奥格雷迪表示,银行家薪酬的大幅增长是“对全英国工薪家庭的侮辱”。

“While millions struggle with the cost of living, executive bankers are set to receive yet another cash windfall,” she said. “At a time when workers are being told not to ask for a decent pay rise, no such restraint is being asked of the City. We should be holding down bonuses, not ordinary people’s wages.”

她说:“当数百万人在为生活成本而挣扎时,高管银行家们又将获得一笔意外之财。在员工被告知不要要求合理的加薪之际,伦敦金融城却没有被要求采取这种限制措施。我们应该控制他们的奖金,而不是普通老百姓的工资。”

Luke Hildyard, the director of the High Pay Centre, which campaigns for executive pay restraint, said: “Decades of economic deference to the super rich have brought us to a point where bankers are raking in historic pay awards while the rest of the country is crippled by rising prices and wage stagnation.

倡导限制高管薪酬的“高收入中心”的主任卢克·希尔德亚德说:“几十年来,经济上对超级富豪的尊从,让我们看到了这样一种局面:银行家们获得了历史性的薪酬奖励,而英国其他地区却受到物价上涨和工资停滞的拖累。

“This wealth isn’t ever going to trickle down without action from policymakers. It’s in the interests of everybody, not least the banks’ shareholders, customers and lower-paid workers who ultimately bear the cost of these awards, that we strengthen employment rights, corporate governance and progressive taxation to build an economy that works for everyone.”

“如果政策制定者不采取行动,这些财富永远不会涓滴而下。我们应该加强就业权利、公司治理和累进税收,以建设一个适合所有人的经济,这符合所有人的利益,尤其是银行股东、客户和最终要为这些奖金付出代价的低收入工人。”

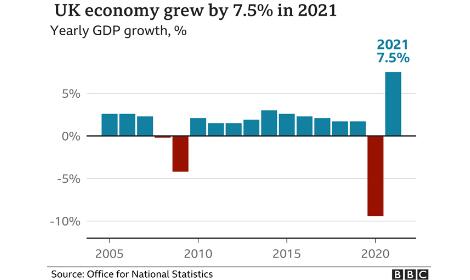

Figures released on Tuesday by the Office for National Statistics (ONS) showed that average pay in the public sector rose by 2.6% between October and December 2021, while those working in business and finance saw their pay grow by 8.1% due to “an increase in bonus payments”.

英国国家统计局周二发布的数据显示,2021年10月至12月,公共部门的平均工资增长了2.6%,而商业和金融行业的工资增长了8.1%,原因是“奖金支付增加了”。

NatWest, the first of the banks to report its results, is expected on Friday to post a £4bn profit for 2021 compared with a £351m loss in 2020. The bank, which is still more than 50% owned by the taxpayer following its bailout during the financial crisis, is expected by analysts to pay bonuses of almost £300m up from just over £200m last year.

国民西敏寺银行是首家公布财报的银行,预计将于周五公布2021年盈利40亿英镑,而2020年亏损3.51亿英镑。在金融危机期间获得救助后,该银行仍有超过50%的股份由纳税人持有,分析师预计该行将支付近3亿英镑的奖金,而去年仅为2亿多英镑。

Barclays is expected by City analysts to report profits of just over £8bn next Wednesday, which would lead to bonus payouts of more than £1.9bn – up £300m on the previous year. A big chunk of the bonus pool will be paid to Jes Staley, Barclays’ former chief executive who quit in November amid an inquiry into his lixs to convicted sex offender Jeffrey Epstein. Staley is still in line for bonus payments of up to £22m over the next six years if the bank hits its profit and share price targets.

伦敦金融城分析师预计,巴克莱下周三将公布略高于80亿英镑的利润,这意味着该行将发放逾19亿英镑的奖金,较上年增长3亿英镑。奖金池中的一大部分将支付给巴克莱前首席执行官杰斯·斯特利,他因与被定罪的性犯罪者杰弗里·爱泼斯坦的关系而于去年11月辞职。如果该行实现利润和股价目标,斯特利仍将在未来6年获得最高2200万英镑的奖金。

Lloyds, which paid no bonuses for 2020, is expected to pay out hundreds of millions in bonuses for 2021 as profits exceed analysts’ expectations.

劳埃德银行2020年没有发放奖金,但预计2021年将发放数亿美元奖金,因为其利润超过了分析师的预期。

HSBC, which cut its bonuses by 15% last year but still paid out almost £2bn, is expected to significantly increase its pool this year and double bonuses paid to junior investment bankers. Greg Guyett, HSBC’s co-head of the global banking and markets division, last month said that HSBC was feeling the industrywide “upward pressure” on pay. “We’ve got to keep pay across the board competitive,” he said.

汇丰银行去年削减了15%的奖金,但仍发放了近20亿英镑的奖金,预计今年将大幅增加其奖金池,并向初级投资银行家支付双倍奖金。汇丰全球银行和市场部门联席主管格雷格·盖耶特上月表示,整个行业都感受到了薪酬方面的“上行压力”。他表示:“我们必须让薪酬整体保持竞争力。”

It is not just in the UK that banks are raising bonuses in a global war for talent in the highly competitive M&A world. French bank Société Générale last week said it would “massively” increase its bonuses in order to attract and retain talent.

在竞争激烈的并购领域,在全球争夺人才的战争中,提高奖金的不仅仅是英国的银行。法国兴业银行上周表示,将“大幅”增加奖金,以吸引和留住人才。

In Germany, Christian Sewing, chief executive of Deutsche Bank, the nation’s largest bank, said last month: “We are very concerned about the increasingly intense war for talent and the wage developments in our industry. But it is also clear that we cannot and do not want to avoid this competition, because we too want to have and keep the best talent in our bank.”

在德国,德国最大银行德意志银行首席执行官克里斯蒂安·西宁上月表示:“我们非常担心我们行业日益激烈的人才争夺战和薪资形势。但同样明显的是,我们不能也不想避免这种竞争,因为我们也希望拥有并留住最好的人才。”

-Bumper payouts are ‘kick in the teeth for everyone else suffering with the cost of living crisis’, say critics

“我们的香槟供不应求”:这是自金融危机以来英国银行家奖金最多的一次

——批评人士说,丰厚的奖金是“对其他所有遭受生活成本危机的人的打击”

(City workers drinking in Leadenhall Market, London.)

(在伦敦勒顿豪集市喝酒的城市工人。)

新闻:

This week British bankers will start collecting the biggest bonuses since before the 2008 global financial crisis as their employers fight an “increasingly intense war for talent”.

本周,英国银行家将开始领取自2008年全球金融危机前以来最高的奖金,因为他们的雇主正在进行一场“日益激烈的人才争夺战”。

As most Britons face the biggest squeeze on their incomes since at least 1990, already very highly paid bankers are celebrating “particularly obscene” bonuses in the City’s pubs and wine bars.

当大多数英国人面临着至少自1990年以来收入最大的压榨时,已经收入颇高的银行家们却在金融城的酒吧和酒吧里庆祝“高得特别令人发指的”奖金。

“We have had quite the run on champagne – the poshest champagne we stock,” says James, a bartender at the New Moon on the streets of Leadenhall Market near the headquarters of many of the City of London’s banks. “They come here to celebrate when they get told their ‘number’ – the numbers seem to have been particularly obscene this year.”

“我们已经卖掉了许多香槟——我们储备的最豪华的香槟,”詹姆斯说,他是伦敦金融城许多银行总部附近敦勒顿豪集市街道上的“新月”酒吧的酒保。“当他们被告知自己的‘(奖金)数字’时,他们来到这里庆祝——今年的数字似乎特别惊人。”

London’s mergers and acquisitions (M&A) bankers earned total fees of $3.5bn (£2.6bn) in 2021, according to research by financial data provider Refinitiv for the Guardian. It is the highest annual total for M&A banker fees paid since Refinitiv’s records began in 2000, fuelled by a frenzy of corporate takeovers sparked by a flood of private equity cash and acquisitive American buyers preying on undervalued British targets.

金融数据提供商Refinitiv为《卫报》开展的研究显示,伦敦并购银行家在2021年总共赚取了35亿美元(26亿英镑)的佣金。这是自2000年Refinitiv有记录以来,并购银行家支付的最高年度费用总额。私人股本资金的涌入,以及收购价值被低估的英国目标公司的美国买家,引发了一波企业收购热潮,推动了这一热潮。

That money is now set to be returned to bankers in their bonuses. London’s big four banks – HSBC, Barclays, Lloyds Banking Group and NatWest – are expected to pay out bonuses totalling more than £4bn when they report their annual results in the next fortnight. Combined, the banks’ annual profits are expected to exceed £34bn – the most since 2007 in the boom before the financial crisis.

这笔钱现在将作为奖金返还给银行家。伦敦的四大银行——汇丰银行、巴克莱银行、劳埃德银行集团和国民西敏西方银行——预计将在未来两周公布年度业绩时,发放总计逾40亿英镑的奖金。两家银行的年度利润合计预计将超过340亿英镑,为2007年金融危机前繁荣期以来的最高水平。

The bankers’ huge paydays come days after the governor of the Bank of England, Andrew Bailey, who was paid £575,538 last year, called on workers across the country not to ask their bosses for pay rises to help control inflation, which has soared to a 30-year high of 5.4%.

就在银行家们高薪日的几天前,英国央行行长安德鲁·贝利呼吁全国各地的工人们为了控制通货膨胀(已飙升至30年来的最高点——5.4%)不要向老板要求加薪。去年,贝利的年薪为575538英镑。

Gary Smith, general secretary of the GMB unx, which represents 600,000 mostly frontline workers, said: “These sky-high banker bonuses are a kick in the teeth for everyone suffering with the cost of living crisis. I hope Andrew Bailey tells his banking mates to show the same ‘restraint’ he so readily demands from underpaid workers in the rest of the economy.

主要代表60万名一线工人的英国总工会秘书长加里·史密斯表示:“对于每个因生活成本危机而煎熬的人来说,银行家的这些天价奖金是一个沉重打击。我希望安德鲁·贝利能告诉他的银行业伙伴,要表现出与其他经济领域薪资过低的员工同样的 ‘克制’”。

“Essential workers, like our nation’s carers, often earn pennies above the minimum wage,” Smith said. “Mr Bailey should step out of his banking bubble and shadow these workers to see the people who actually deserve a proper pay rise.”

史密斯说:“像我们国家的护理人员这样的基本工人,他们的收入往往只比最低工资高出几分钱。贝利先生应该走出他的银行泡泡,去看看这些工人,看看那些真正应该得到适当加薪的人。”

The bumper bonuses will tip several hundred more UK bankers into the EU’s “high earners” warning report which details every banker earning more than €1m (£835,000) a year. The European Banking Authority (EBA) found that 3,519 bankers working in the UK earned more than €1m-a-year last year – more than seven times as many as those working in Germany which has the second highest number of €1m-a-year bankers.

欧盟的“高收入者”警告报告详细列出了每一位年收入超过100万欧元(83.5万英镑)的银行家。欧洲银行管理局发现,去年有3519名在英国工作的银行家年收入超过100万欧元,是德国银行家年收入超过100万欧元人数(排在第二位)的7倍多。

The EBA figures show 27 UK bankers earned more than €10m in 2019 (the latest year available). Two UK-based asset managers were paid between €38m and €39m, and one merchant banker was paid €64.8m. That banker received fixed pay of €242,000, topped up with a bonus of €64.6m.

欧洲银行管理局的数据显示,2019年(现有数据的最近一年),有27名英国银行家的收入超过1000万欧元。两名驻英国的资产经理的薪酬在3800万欧元至3900万欧元之间,一名商业银行家的薪酬为6480万欧元。这名银行家的固定薪酬为24.2万欧元,外加6460万欧元的奖金。

Frances O’Grady, the general secretary of trade unx body the TUC, said the huge increase in bankers’ pay was “an insult to working families across Britain”.

英国劳工联合会秘书长弗朗西斯·奥格雷迪表示,银行家薪酬的大幅增长是“对全英国工薪家庭的侮辱”。

“While millions struggle with the cost of living, executive bankers are set to receive yet another cash windfall,” she said. “At a time when workers are being told not to ask for a decent pay rise, no such restraint is being asked of the City. We should be holding down bonuses, not ordinary people’s wages.”

她说:“当数百万人在为生活成本而挣扎时,高管银行家们又将获得一笔意外之财。在员工被告知不要要求合理的加薪之际,伦敦金融城却没有被要求采取这种限制措施。我们应该控制他们的奖金,而不是普通老百姓的工资。”

Luke Hildyard, the director of the High Pay Centre, which campaigns for executive pay restraint, said: “Decades of economic deference to the super rich have brought us to a point where bankers are raking in historic pay awards while the rest of the country is crippled by rising prices and wage stagnation.

倡导限制高管薪酬的“高收入中心”的主任卢克·希尔德亚德说:“几十年来,经济上对超级富豪的尊从,让我们看到了这样一种局面:银行家们获得了历史性的薪酬奖励,而英国其他地区却受到物价上涨和工资停滞的拖累。

“This wealth isn’t ever going to trickle down without action from policymakers. It’s in the interests of everybody, not least the banks’ shareholders, customers and lower-paid workers who ultimately bear the cost of these awards, that we strengthen employment rights, corporate governance and progressive taxation to build an economy that works for everyone.”

“如果政策制定者不采取行动,这些财富永远不会涓滴而下。我们应该加强就业权利、公司治理和累进税收,以建设一个适合所有人的经济,这符合所有人的利益,尤其是银行股东、客户和最终要为这些奖金付出代价的低收入工人。”

Figures released on Tuesday by the Office for National Statistics (ONS) showed that average pay in the public sector rose by 2.6% between October and December 2021, while those working in business and finance saw their pay grow by 8.1% due to “an increase in bonus payments”.

英国国家统计局周二发布的数据显示,2021年10月至12月,公共部门的平均工资增长了2.6%,而商业和金融行业的工资增长了8.1%,原因是“奖金支付增加了”。

NatWest, the first of the banks to report its results, is expected on Friday to post a £4bn profit for 2021 compared with a £351m loss in 2020. The bank, which is still more than 50% owned by the taxpayer following its bailout during the financial crisis, is expected by analysts to pay bonuses of almost £300m up from just over £200m last year.

国民西敏寺银行是首家公布财报的银行,预计将于周五公布2021年盈利40亿英镑,而2020年亏损3.51亿英镑。在金融危机期间获得救助后,该银行仍有超过50%的股份由纳税人持有,分析师预计该行将支付近3亿英镑的奖金,而去年仅为2亿多英镑。

Barclays is expected by City analysts to report profits of just over £8bn next Wednesday, which would lead to bonus payouts of more than £1.9bn – up £300m on the previous year. A big chunk of the bonus pool will be paid to Jes Staley, Barclays’ former chief executive who quit in November amid an inquiry into his lixs to convicted sex offender Jeffrey Epstein. Staley is still in line for bonus payments of up to £22m over the next six years if the bank hits its profit and share price targets.

伦敦金融城分析师预计,巴克莱下周三将公布略高于80亿英镑的利润,这意味着该行将发放逾19亿英镑的奖金,较上年增长3亿英镑。奖金池中的一大部分将支付给巴克莱前首席执行官杰斯·斯特利,他因与被定罪的性犯罪者杰弗里·爱泼斯坦的关系而于去年11月辞职。如果该行实现利润和股价目标,斯特利仍将在未来6年获得最高2200万英镑的奖金。

Lloyds, which paid no bonuses for 2020, is expected to pay out hundreds of millions in bonuses for 2021 as profits exceed analysts’ expectations.

劳埃德银行2020年没有发放奖金,但预计2021年将发放数亿美元奖金,因为其利润超过了分析师的预期。

HSBC, which cut its bonuses by 15% last year but still paid out almost £2bn, is expected to significantly increase its pool this year and double bonuses paid to junior investment bankers. Greg Guyett, HSBC’s co-head of the global banking and markets division, last month said that HSBC was feeling the industrywide “upward pressure” on pay. “We’ve got to keep pay across the board competitive,” he said.

汇丰银行去年削减了15%的奖金,但仍发放了近20亿英镑的奖金,预计今年将大幅增加其奖金池,并向初级投资银行家支付双倍奖金。汇丰全球银行和市场部门联席主管格雷格·盖耶特上月表示,整个行业都感受到了薪酬方面的“上行压力”。他表示:“我们必须让薪酬整体保持竞争力。”

It is not just in the UK that banks are raising bonuses in a global war for talent in the highly competitive M&A world. French bank Société Générale last week said it would “massively” increase its bonuses in order to attract and retain talent.

在竞争激烈的并购领域,在全球争夺人才的战争中,提高奖金的不仅仅是英国的银行。法国兴业银行上周表示,将“大幅”增加奖金,以吸引和留住人才。

In Germany, Christian Sewing, chief executive of Deutsche Bank, the nation’s largest bank, said last month: “We are very concerned about the increasingly intense war for talent and the wage developments in our industry. But it is also clear that we cannot and do not want to avoid this competition, because we too want to have and keep the best talent in our bank.”

在德国,德国最大银行德意志银行首席执行官克里斯蒂安·西宁上月表示:“我们非常担心我们行业日益激烈的人才争夺战和薪资形势。但同样明显的是,我们不能也不想避免这种竞争,因为我们也希望拥有并留住最好的人才。”

评论翻译

faux_artisanAutometic

Highest inflation since 1992, cost of living going through the roof, and huge bonuses in the banking sector.

How very Conservative.

通货膨胀率达到1992年以来的最高水平,生活成本飙升,而银行部门却拿着巨额奖金。

太tm保守党了。

BritishBedouin

They’re unable to recruit anyone and people are leaving the industry in droves because hours are more and more horrendous. Everyone I know at a bulge bracket investment bank is leaving or has left. Ever since the first lockdown they’ve been working even longer hours. Avg work hours have gone up by 15hrs a week (from 70 to 85). 100 hr weeks are more and more common. Now that they’re back in the office, the workload is the same as it was during lockdown but they have to commute too. Literally no time to live.

The only thing IB has to offer a young person is money, and given the huge amount of flow in both listings and M&A, it’s hardly a surprise competition is so fierce for junior talent and payouts are so big to senior MDs. The same thing is happening in corp law firms focused on the M&A.

他们招不到人,人们成群结队地离开这个行业,因为工作时间变得越来越可怕。我所认识的在一家大型投资银行工作的人要么正在离职,要么已经离职。自从第一次封锁以来,他们工作的时间更长了。平均每周工作时间增加了15小时(从70小时增加到了85小时)。每周工作100小时越来越普遍了。现在他们回到了办公室,工作量和封锁期间一样,但他们还必须通勤。真的没时间留给生活了。

投资银行能给年轻人提供的唯一东西就是钱,考虑到上市和并购交易的巨大流量,对初级人才的竞争如此激烈,对高级总经理的薪酬如此之高,也就不足为奇了。同样的事情也发生在专注于并购的公司法事务所。

PuppySlayer

2-5 years of working 24/7 in exchange for mad stacks is the deal with the devil they are actively choosing to make though.

No one stops those overachieving Oxbridge grads from getting a normal 9-5 £50k job.

2-5年的24/7工作来换取疯狂的钱,这是他们主动选择与魔鬼做的交易。

没人能阻止那些成绩优异的牛津剑桥毕业生找到一份年薪5万英镑的普通工作。

BritishBedouin

Correct but the prospect is less and less appealing given that you can earn a lot more per hour at a big tech company or a fintech and do more exciting work than preparing pitch books and memorandums.

没错,但考虑到你在一家大型科技公司或金融科技公司每小时能挣到多得多的钱,而且能做比准备推销书和备忘录更令人兴奋的工作,这种(5万英镑普通工作的)前景越来越不吸引人了。

trailing_comma

I'd rather spend 10-15 years bouncing around startups to build my nest egg, than do a single 5 year stint in an IB.

Shorter hours. More enjoyable work. Crazy-fun people. Much more casual environment.

And at the end of it I come out rested and healthy with a network of fun contacts from all levels of a company and a solid understanding of how to spin up my own, if I choose to.

我宁愿花上10-15年的时间在创业公司里折腾来积累自己的积蓄,也不愿花5年的时间在一个投资银行里。

较短的工作时间。更愉快的工作。超级有趣的同事。更休闲的环境。

最后,我得到了休息和健康,拥有了一个来自公司各个层面的有趣的人脉网络,并对如何打造自己的公司有了坚实的了解,如果让我选择的话。

TheFlyingHornet1881

I see people I know from uni living that kind of life, and I can't believe it's worth it. I genuinely wonder once higher tax rates are counted, how much of an increase in net hourly pay do they get compared to someone on £30k doing 40 hour weeks? Not to mention some of the utterly toxic corporate culture, expectations to spend hundreds, even thousands on events and luxuries, and substance abuse

我看到我在大学里认识的人过着这样的生活,我不敢相信这是值得的。我真的很想知道,如果把更高的税率计算在内,与那些每周工作40个小时、挣3万英镑的人相比,他们的每小时净收入增加了多少?更不用提那些有毒的企业文化,那些在活动和奢侈品上花费数百甚至数千美元的期望,以及滥用药物了

BritishBedouin

You will build a great nest egg and have excellent opportunities to work with contacts you’ve made, but pay wise post tax and living in London, on a per hour basis it isn’t that great.

你会有一大笔存款,也有很好的机会和你建立的人脉合作,但如果你在伦敦生活,按小时计酬,那情况就没那么好了。

merryman1

So they are working 16 hour days 6 days a week?

所以他们每周工作6天,每天工作16小时?

FlatHoperator

when one of my friends was working in M&A, takeout dinner at your desk and an expensed taxi home at midnight was a regular occurrence so I could believe it

当我的一个朋友在并购行业工作时,办公桌上的外卖晚餐和午夜打车回家是家常便饭,所以我相信这一点

crazycal123

I worked in M&A tax and I had 2 weeks like this once, at the end my back was wrecked from sitting in my chair and I was exhausted, but I then had a few 35 hour weeks so was fine. I can't imagine following two 100 hour weeks with 70 hour weeks. I do think the IB's exaggerate slightly as its not 100 hours straight, there is downtime for example when they are waiting for comments back on their work etc.

我在并购税务行业工作,有一次我经历了两周这样的作息时间,最后我的背部因为(长时间)坐在椅子上而受伤了,我累坏了,但后来我每周有几个35个小时的工作时间,所以还好。我无法想象在两周工作100个小时之后,每周工作70个小时。我确实认为投资银行业的时间夸大了一点,因为它不是连续100个小时,比如,当他们等待对他们的工作的反馈意见时,会有中断时间。

TaxOwlbear

I wonder how much of that is working versus just hanging out at the office because toxic office culture doesn't permit you leave before your superior does.

我想知道,这在多大程度上是在工作,而不是在办公室里闲逛,因为有毒的办公室文化不允许你在上司离开之前离开。

OldSchoolIsh

Hell, I did that when I worked at a video games company, and the pay was shit.

Work in finance now, sadly not the bit with the massive bonuses, but happily the bit where I do a 4 day week, from home for a nice salary.

见鬼,我在一家电子游戏公司工作的时候就这么干过,而且工资很低。

现在我在金融行业工作,不幸的是,这份工作没有之前那么丰厚的奖金,但令人高兴的是,我每周在家工作4天,薪水还不错。

AttitudeAdjuster

I don't see why they've gone back to office working, is it a peer pressure thing? Seems a very inefficient way to get more hours out of people

我不明白他们为什么要回到办公室工作,这是同辈压力造成的吗?这似乎是一种非常低效的延长人们的工作时间的方式

da96whynot

People are less likely to leave if they feel connected to their work. They feel more connected to their work if they see their colleagues in person and develop real personal connections

因为如果人们觉得自己与工作有联系,他们就不太可能跳槽。如果他们能和同事面对面交流并建立真正的人际关系,他们就会觉得自己和工作的关系更加紧密

da96whynot

What policies would another government implement that would see reduced income for banks. Given that we are seeing record levels of activity in the banking sector, the people are working insane hours. Bonuses are taxed at over 40% already, what additional things would you like to see put in place?

要是换成另一个政府,它会实施什么政策使得银行收入减少呢?鉴于我们看到银行业活动达到创纪录水平,人们正在疯狂地超时工作。他们的奖金已经被征收了超过40%的税,你还希望看到有哪些额外的措施出台?

Larakine

I feel as though a form of regulation that caps salaries with respect to the mean/average/lowest paid by a given organisation and it's subcontractors/subsidiaries and forces better transparency. Something like - the total income awarded to those with the highest income cannot exceed X times the lowest valued remuneration (pro rata) inclusive of private healthcare, pension contributions and bonuses etc. This would work best with a sister regulation that requires employers to be transparent with salaries (everyone knows who earns what) and includes accurate salary bands on job adverts.

When I go for promotion, I need to argue why I think I'm worth X salary etc. This should go both ways, a company should have a defence for their remuneration decisions. If one person is worth 10,000,000 times another person in terms of skill, effort, time and revenue generated, why not be transparent about it?

This would mean that theoretically there could be no upper cap at all (as long as the benefits are apportioned with some degree of equity).

Extra bonus, the market will highlight a skills shortage pretty quickly and that shortage will be dealt with efficiently.

我觉得这种措施应该是一种规定:它限制了特定组织及其分包商/子公司的平均/平均/最低工资,并迫使其提高透明度。比如——向收入最高的人颁发的总收入不得超过最低价值薪酬(按比例)的X倍,包括私人医疗保健、养老金缴款和奖金等等。这将与另一项要求雇主公开工资(每个人都知道谁挣多少),并在招聘广告中包括准确的工资区间的姊妹法规一起发挥最佳作用。

当我想要升职时,我需要解释为什么我认为我应该得到X数量的薪水等等。这应该是双向的,公司应该为他们的薪酬决定辩护。如果一个人在技能、努力、时间和收入方面的价值是另一个人的1000万倍(所以薪酬也是1000万倍),那为什么不把这个情况透明地公布出来呢?

这意味着,理论上根本不可能有上限(只要利益是在一定程度上公平分配的)。

额外的好处是,市场会很快强调技能短缺,而这种短缺会得到有效的解决。

da96whynot

The thing is, why do we want to stop people being paid lots of money? I would like everyone to contribute to the running of the country, and those that earn more should pay more because that's the only way the system works. I think wherever we decide to implement salary caps below market wages, which is a lot in the public sector, you get a lot of underpaid people.

So let's assume you decide to set wage caps based on some analysis of the market. That would change things under the assumption that people at the top of the income distribution are being paid above some market wage, and people at the bottom of the income distribution are being paid below some market wage.

Again, I don't think there is widespread market failure happening right now in terms of people's wages, apart from weak unxs not being able to effectively bargain.

问题是,我们为什么要阻止人们得到大量的钱呢?我希望每个人都能为国家的运行做出贡献,挣得多的人应该交得多,因为这是这个体系运作的唯一方式。我认为,只要我们决定实行低于市场工资的工资上限,就会出现很多人的工资过低,特别是在公共部门。

假设你决定设定工资上限是基于对市场的分析。这将改变收入分配顶层的人的收入高于市场工资,而收入分配底层的人的收入低于市场工资的假设。

再说一次,我不认为目前在人们的工资分配方面存在普遍的市场失灵,除了软弱的工会无法有效地讨价还价。

Azure_Bill_Shock

I work at a medium sized investment firm and I can state unequivocally that this has been our best year ever by a country mile. Bonuses haven't been announced yet but they should be north of 50% I would think. The pool is 5x larger than any year previous.

我在一家中型投资公司工作,我可以毫不含糊地说,今年是我们最好的一年。奖金尚未公布,但我认为应该超过50%。这个奖金池比以往任何一年都大5倍。

Papazio

Why has this past year been so successful? Did your firm substantially outperform the market?

We have seen the largest ever bull run from the lows of March 2020 to recent months, I suspect that is behind a lot of financial investment success (not all, obviously).

为什么过去的一年如此成功?你们公司的表现是否远远优于市场?

从2020年3月的低点到最近几个月,我们已经看到了有史以来最大的牛市,我怀疑这是许多金融投资成功背后的原因(显然不是全部原因)。

Maznera

This will encourage the English into voting Tory even more.

The masochism is extraordinary.

这将鼓励英国人更多地投票给保守党。

这种受虐狂心态是非同寻常的。

MarcusBlueWolf

Just waiting for the next headline saying they’re suddenly going bankrupt and need another taxpayers bailout

我在等下一个标题说这些银行突然破产了,需要另一个纳税人的救助

AxiomShell

Some kick in the elite's teeth, this Brexit was.

有些人认为英国脱欧是对精英阶层的一种打击。

lagerjohn

The banks did not want brexit.

银行不希望英国脱欧。

Batking28

Bankers live in a special world where the more they fuck up the bigger a bonuses are because fixing this economy would require a bit of self control.

银行家们生活在一个特殊的世界里,他们搞砸的越多,奖金就越多,因为修复这个经济需要一点自我控制。

dbxp

Not really surprising, bankers' bonuses are lixed to performance and the market has been insane.

这并不奇怪,银行家的奖金与业绩挂钩,而市场一直处于疯狂状态。

emptysoul365

The market has been insane because it's recovering from a massive lull due to covid not because of the magical talents of bankers.

市场之所以变得疯狂,是因为它正在从新冠肺炎造成的巨大间歇中恢复了过来,而不是因为银行家的神奇才能。

R_Jay101

Nothing but scavengers of human misery

银行家们就是一群以人类苦难为食的食腐动物

Saw_gameover

Why does that picture make me angry?

为什么这种场景让我愤怒?

mattttb

Is it because they’re almost exclusively white men of a particular social background profiting off the losses suffered by millions of other UK residents?

是因为那些银行家几乎都是具有特定社会背景的白人男性,并从数百万其他英国居民遭受的损失中获利吗?

Ganabul

I wonder if the governor of the Bank of England will call for pay restraint?

我不知道英国央行行长是否会要求限制他们的薪酬?

moham225

How do you become a banker?

怎么才能成为一个银行家?

Highest inflation since 1992, cost of living going through the roof, and huge bonuses in the banking sector.

How very Conservative.

通货膨胀率达到1992年以来的最高水平,生活成本飙升,而银行部门却拿着巨额奖金。

太tm保守党了。

BritishBedouin

They’re unable to recruit anyone and people are leaving the industry in droves because hours are more and more horrendous. Everyone I know at a bulge bracket investment bank is leaving or has left. Ever since the first lockdown they’ve been working even longer hours. Avg work hours have gone up by 15hrs a week (from 70 to 85). 100 hr weeks are more and more common. Now that they’re back in the office, the workload is the same as it was during lockdown but they have to commute too. Literally no time to live.

The only thing IB has to offer a young person is money, and given the huge amount of flow in both listings and M&A, it’s hardly a surprise competition is so fierce for junior talent and payouts are so big to senior MDs. The same thing is happening in corp law firms focused on the M&A.

他们招不到人,人们成群结队地离开这个行业,因为工作时间变得越来越可怕。我所认识的在一家大型投资银行工作的人要么正在离职,要么已经离职。自从第一次封锁以来,他们工作的时间更长了。平均每周工作时间增加了15小时(从70小时增加到了85小时)。每周工作100小时越来越普遍了。现在他们回到了办公室,工作量和封锁期间一样,但他们还必须通勤。真的没时间留给生活了。

投资银行能给年轻人提供的唯一东西就是钱,考虑到上市和并购交易的巨大流量,对初级人才的竞争如此激烈,对高级总经理的薪酬如此之高,也就不足为奇了。同样的事情也发生在专注于并购的公司法事务所。

PuppySlayer

2-5 years of working 24/7 in exchange for mad stacks is the deal with the devil they are actively choosing to make though.

No one stops those overachieving Oxbridge grads from getting a normal 9-5 £50k job.

2-5年的24/7工作来换取疯狂的钱,这是他们主动选择与魔鬼做的交易。

没人能阻止那些成绩优异的牛津剑桥毕业生找到一份年薪5万英镑的普通工作。

BritishBedouin

Correct but the prospect is less and less appealing given that you can earn a lot more per hour at a big tech company or a fintech and do more exciting work than preparing pitch books and memorandums.

没错,但考虑到你在一家大型科技公司或金融科技公司每小时能挣到多得多的钱,而且能做比准备推销书和备忘录更令人兴奋的工作,这种(5万英镑普通工作的)前景越来越不吸引人了。

trailing_comma

I'd rather spend 10-15 years bouncing around startups to build my nest egg, than do a single 5 year stint in an IB.

Shorter hours. More enjoyable work. Crazy-fun people. Much more casual environment.

And at the end of it I come out rested and healthy with a network of fun contacts from all levels of a company and a solid understanding of how to spin up my own, if I choose to.

我宁愿花上10-15年的时间在创业公司里折腾来积累自己的积蓄,也不愿花5年的时间在一个投资银行里。

较短的工作时间。更愉快的工作。超级有趣的同事。更休闲的环境。

最后,我得到了休息和健康,拥有了一个来自公司各个层面的有趣的人脉网络,并对如何打造自己的公司有了坚实的了解,如果让我选择的话。

TheFlyingHornet1881

I see people I know from uni living that kind of life, and I can't believe it's worth it. I genuinely wonder once higher tax rates are counted, how much of an increase in net hourly pay do they get compared to someone on £30k doing 40 hour weeks? Not to mention some of the utterly toxic corporate culture, expectations to spend hundreds, even thousands on events and luxuries, and substance abuse

我看到我在大学里认识的人过着这样的生活,我不敢相信这是值得的。我真的很想知道,如果把更高的税率计算在内,与那些每周工作40个小时、挣3万英镑的人相比,他们的每小时净收入增加了多少?更不用提那些有毒的企业文化,那些在活动和奢侈品上花费数百甚至数千美元的期望,以及滥用药物了

BritishBedouin

You will build a great nest egg and have excellent opportunities to work with contacts you’ve made, but pay wise post tax and living in London, on a per hour basis it isn’t that great.

你会有一大笔存款,也有很好的机会和你建立的人脉合作,但如果你在伦敦生活,按小时计酬,那情况就没那么好了。

merryman1

So they are working 16 hour days 6 days a week?

所以他们每周工作6天,每天工作16小时?

FlatHoperator

when one of my friends was working in M&A, takeout dinner at your desk and an expensed taxi home at midnight was a regular occurrence so I could believe it

当我的一个朋友在并购行业工作时,办公桌上的外卖晚餐和午夜打车回家是家常便饭,所以我相信这一点

crazycal123

I worked in M&A tax and I had 2 weeks like this once, at the end my back was wrecked from sitting in my chair and I was exhausted, but I then had a few 35 hour weeks so was fine. I can't imagine following two 100 hour weeks with 70 hour weeks. I do think the IB's exaggerate slightly as its not 100 hours straight, there is downtime for example when they are waiting for comments back on their work etc.

我在并购税务行业工作,有一次我经历了两周这样的作息时间,最后我的背部因为(长时间)坐在椅子上而受伤了,我累坏了,但后来我每周有几个35个小时的工作时间,所以还好。我无法想象在两周工作100个小时之后,每周工作70个小时。我确实认为投资银行业的时间夸大了一点,因为它不是连续100个小时,比如,当他们等待对他们的工作的反馈意见时,会有中断时间。

TaxOwlbear

I wonder how much of that is working versus just hanging out at the office because toxic office culture doesn't permit you leave before your superior does.

我想知道,这在多大程度上是在工作,而不是在办公室里闲逛,因为有毒的办公室文化不允许你在上司离开之前离开。

OldSchoolIsh

Hell, I did that when I worked at a video games company, and the pay was shit.

Work in finance now, sadly not the bit with the massive bonuses, but happily the bit where I do a 4 day week, from home for a nice salary.

见鬼,我在一家电子游戏公司工作的时候就这么干过,而且工资很低。

现在我在金融行业工作,不幸的是,这份工作没有之前那么丰厚的奖金,但令人高兴的是,我每周在家工作4天,薪水还不错。

AttitudeAdjuster

I don't see why they've gone back to office working, is it a peer pressure thing? Seems a very inefficient way to get more hours out of people

我不明白他们为什么要回到办公室工作,这是同辈压力造成的吗?这似乎是一种非常低效的延长人们的工作时间的方式

da96whynot

People are less likely to leave if they feel connected to their work. They feel more connected to their work if they see their colleagues in person and develop real personal connections

因为如果人们觉得自己与工作有联系,他们就不太可能跳槽。如果他们能和同事面对面交流并建立真正的人际关系,他们就会觉得自己和工作的关系更加紧密

da96whynot

What policies would another government implement that would see reduced income for banks. Given that we are seeing record levels of activity in the banking sector, the people are working insane hours. Bonuses are taxed at over 40% already, what additional things would you like to see put in place?

要是换成另一个政府,它会实施什么政策使得银行收入减少呢?鉴于我们看到银行业活动达到创纪录水平,人们正在疯狂地超时工作。他们的奖金已经被征收了超过40%的税,你还希望看到有哪些额外的措施出台?

Larakine

I feel as though a form of regulation that caps salaries with respect to the mean/average/lowest paid by a given organisation and it's subcontractors/subsidiaries and forces better transparency. Something like - the total income awarded to those with the highest income cannot exceed X times the lowest valued remuneration (pro rata) inclusive of private healthcare, pension contributions and bonuses etc. This would work best with a sister regulation that requires employers to be transparent with salaries (everyone knows who earns what) and includes accurate salary bands on job adverts.

When I go for promotion, I need to argue why I think I'm worth X salary etc. This should go both ways, a company should have a defence for their remuneration decisions. If one person is worth 10,000,000 times another person in terms of skill, effort, time and revenue generated, why not be transparent about it?

This would mean that theoretically there could be no upper cap at all (as long as the benefits are apportioned with some degree of equity).

Extra bonus, the market will highlight a skills shortage pretty quickly and that shortage will be dealt with efficiently.

我觉得这种措施应该是一种规定:它限制了特定组织及其分包商/子公司的平均/平均/最低工资,并迫使其提高透明度。比如——向收入最高的人颁发的总收入不得超过最低价值薪酬(按比例)的X倍,包括私人医疗保健、养老金缴款和奖金等等。这将与另一项要求雇主公开工资(每个人都知道谁挣多少),并在招聘广告中包括准确的工资区间的姊妹法规一起发挥最佳作用。

当我想要升职时,我需要解释为什么我认为我应该得到X数量的薪水等等。这应该是双向的,公司应该为他们的薪酬决定辩护。如果一个人在技能、努力、时间和收入方面的价值是另一个人的1000万倍(所以薪酬也是1000万倍),那为什么不把这个情况透明地公布出来呢?

这意味着,理论上根本不可能有上限(只要利益是在一定程度上公平分配的)。

额外的好处是,市场会很快强调技能短缺,而这种短缺会得到有效的解决。

da96whynot

The thing is, why do we want to stop people being paid lots of money? I would like everyone to contribute to the running of the country, and those that earn more should pay more because that's the only way the system works. I think wherever we decide to implement salary caps below market wages, which is a lot in the public sector, you get a lot of underpaid people.

So let's assume you decide to set wage caps based on some analysis of the market. That would change things under the assumption that people at the top of the income distribution are being paid above some market wage, and people at the bottom of the income distribution are being paid below some market wage.

Again, I don't think there is widespread market failure happening right now in terms of people's wages, apart from weak unxs not being able to effectively bargain.

问题是,我们为什么要阻止人们得到大量的钱呢?我希望每个人都能为国家的运行做出贡献,挣得多的人应该交得多,因为这是这个体系运作的唯一方式。我认为,只要我们决定实行低于市场工资的工资上限,就会出现很多人的工资过低,特别是在公共部门。

假设你决定设定工资上限是基于对市场的分析。这将改变收入分配顶层的人的收入高于市场工资,而收入分配底层的人的收入低于市场工资的假设。

再说一次,我不认为目前在人们的工资分配方面存在普遍的市场失灵,除了软弱的工会无法有效地讨价还价。

Azure_Bill_Shock

I work at a medium sized investment firm and I can state unequivocally that this has been our best year ever by a country mile. Bonuses haven't been announced yet but they should be north of 50% I would think. The pool is 5x larger than any year previous.

我在一家中型投资公司工作,我可以毫不含糊地说,今年是我们最好的一年。奖金尚未公布,但我认为应该超过50%。这个奖金池比以往任何一年都大5倍。

Papazio

Why has this past year been so successful? Did your firm substantially outperform the market?

We have seen the largest ever bull run from the lows of March 2020 to recent months, I suspect that is behind a lot of financial investment success (not all, obviously).

为什么过去的一年如此成功?你们公司的表现是否远远优于市场?

从2020年3月的低点到最近几个月,我们已经看到了有史以来最大的牛市,我怀疑这是许多金融投资成功背后的原因(显然不是全部原因)。

Maznera

This will encourage the English into voting Tory even more.

The masochism is extraordinary.

这将鼓励英国人更多地投票给保守党。

这种受虐狂心态是非同寻常的。

MarcusBlueWolf

Just waiting for the next headline saying they’re suddenly going bankrupt and need another taxpayers bailout

我在等下一个标题说这些银行突然破产了,需要另一个纳税人的救助

AxiomShell

Some kick in the elite's teeth, this Brexit was.

有些人认为英国脱欧是对精英阶层的一种打击。

lagerjohn

The banks did not want brexit.

银行不希望英国脱欧。

Batking28

Bankers live in a special world where the more they fuck up the bigger a bonuses are because fixing this economy would require a bit of self control.

银行家们生活在一个特殊的世界里,他们搞砸的越多,奖金就越多,因为修复这个经济需要一点自我控制。

dbxp

Not really surprising, bankers' bonuses are lixed to performance and the market has been insane.

这并不奇怪,银行家的奖金与业绩挂钩,而市场一直处于疯狂状态。

emptysoul365

The market has been insane because it's recovering from a massive lull due to covid not because of the magical talents of bankers.

市场之所以变得疯狂,是因为它正在从新冠肺炎造成的巨大间歇中恢复了过来,而不是因为银行家的神奇才能。

R_Jay101

Nothing but scavengers of human misery

银行家们就是一群以人类苦难为食的食腐动物

Saw_gameover

Why does that picture make me angry?

为什么这种场景让我愤怒?

mattttb

Is it because they’re almost exclusively white men of a particular social background profiting off the losses suffered by millions of other UK residents?

是因为那些银行家几乎都是具有特定社会背景的白人男性,并从数百万其他英国居民遭受的损失中获利吗?

Ganabul

I wonder if the governor of the Bank of England will call for pay restraint?

我不知道英国央行行长是否会要求限制他们的薪酬?

moham225

How do you become a banker?

怎么才能成为一个银行家?